Price and Intensity Identified as the Major Drivers of Rising Healthcare Spending

Last Updated November 8, 2017

Nov 8, 2017

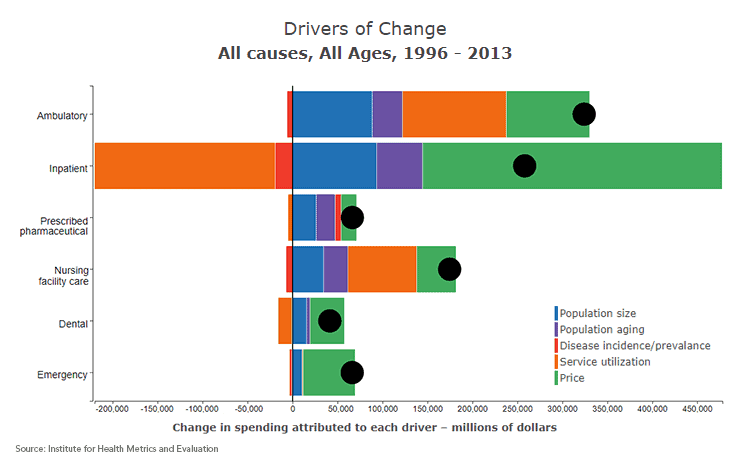

A new study published in JAMA (The Journal of the American Medical Association) reveals that healthcare spending rose by nearly $1 trillion between 1996 and 2013. The research, conducted by the University of Washington’s Institute for Health Metrics and Evaluation (IHME) and funded by the Peterson Center on Healthcare, explored five drivers of this growth in spending:

- A growing population;

- An aging population;

- Changes in disease prevalence and incidence;

- Increases in how often people receive healthcare; and

- Increases in the price and intensity (variety and complexity) of services.

Important takeaways from the study include:

- Healthcare spending increased 80 percent, or $934 billion, between 1996 and 2013;

- Changes in both the price and intensity of care led to a 50 percent spending increase—by far, the biggest contributors to spending growth; and

- A growing and aging population only drove spending increases of 23.1 percent and 11.6 percent, respectively.

These findings offer insight into why the U.S. spends so much on healthcare. Since price and intensity are the driving factors, the research suggests the need for more efforts to address those forces that control pricing.

IHME’s research reinforces our interest in increasing price transparency and understanding whether more complex services produce better results for patients.

OUR WORK WITH IHME

The article, “Factors Associated With Increases in US Health Care Spending, 1996–2013,” was produced as part of a grant awarded in March 2016 by the Peterson Center on Healthcare to the University of Washington to analyze drivers of healthcare spending and identify future trends to guide efforts to improve health outcomes and bend the cost curve.

For the next phase of the work, IHME will compare the impact of these drivers on public and private payer spending as well as out-of-pocket costs. The institute will then forecast healthcare spending through 2040 and develop alternative scenarios to explore what changes among these drivers could have the greatest impact on slowing healthcare spending.

The objective is for healthcare decision makers and stakeholders to use the historical analysis and future projections to guide investments that will improve outcomes and moderate the trajectory of healthcare spending.

Read More:

Why Americans pay so much more for healthcare in 2024

Executive Director Caroline Pearson reflects on why Americans continue to pay more for healthcare each year in USA TODAY.

Privately Insured People With Depression and Anxiety Face High Out-Of-Pocket Costs

In this brief, we explore health spending among privately insured adults treated for depression and/or anxiety.

Use of ACA Preventive Services Potentially Affected by Braidwood v. Becerra

In this analysis, we find that nearly 10 million people who use ACA preventive care could face higher out-of-pocket costs.